aviation

Smaller jets see an upswing in cargo transport

Online retail is causing a package boom that is benefiting the air freight business. Fast deliveries are ensured by widebody freighters with backup from smaller jets.

author: Nicole Geffert | 6 mins reading time published on: 08.09.2021

author:

Nicole Geffert

has been working as a freelance journalist covering topics such as research and science, money and taxes, and education and careers since 1999.

A topflight consignment of air freight: 247 sport horses along with their grooms, feed and tons of equipment were flown on board a specially converted Boeing 777 freighter on a total of eight special charters from Liège Airport in Belgium to the Tokyo Olympic Games.

“For many airlines, cargo business is currently playing a much more important role than it did prior to the pandemic”

Director Business Development – MRO at MTU Aero Engines

When it comes to transporting premium and time-sensitive goods, aircraft have the edge over ships as the means of transportation. This became even clearer in March 2021, when the Ever Given ran aground in the Suez Canal, blocking this key waterway between Asia and Europe for six days and causing major disruption to global trade. Meanwhile, air freight boomed—and this sector continues to soar while passenger air travel begins to slowly recover from the consequences of the Covid-19 pandemic.

“For many airlines, cargo business is currently playing a much more important role than it did prior to the pandemic,” says Marko Niffka, Director Business Development – MRO at MTU Aero Engines. According to the International Air Transport Association (IATA), air freight will account for approximately 33 percent of the entire aviation industry’s global revenue for 2021. By comparison, before the pandemic that figure was between 10 and 15 percent.

Other forecasts inspire confidence as well. IATA predicts that the global aviation industry will handle 63.1 million metric tons of freight in 2021. This will come close to equaling the record volume of 2018, the best year in the history of air freight, when 63.5 million metric tons of freight were handled. The total of cargo tonne-kilometers (CTKs) for 2021 is expected to rise by 13.1 percent compared to 2020, an increase driven by economic growth in trade and production. That economic growth has been estimated at 8 percent over 2020, according to figures published by the World Trade Organization (WTO).

Global sales distribution in the aviation industry – cargo vs. passenger

Getting there faster: Online retail has skyrocketed because of the pandemic, which has led to a considerable boom in freight business. No one ordering online wants to wait weeks to get their hands on their eagerly anticipated goods. Deliveries must be made swiftly—and that’s where transport via air has the edge.

E-commerce allows the market to stretch its wings

Global exports dropped for a while in spring 2020. “Prior to the pandemic, around half of all air freight wasn’t transported in freighters, but rather as belly freight—in other words, as additional cargo on passenger aircraft,” Niffka says. Once the pandemic forced airlines to suspend some routes, especially long-haul ones, this capacity for belly freight vanished, which in turn caused transport costs to skyrocket. At the same time, demand for fast deliveries of desperately needed goods increased.

“Especially at the beginning of the pandemic, it was essential to ensure swift, secure and reliable transports of masks, gowns, medical devices and medications,” Niffka says. “But these transports had only a short-term effect. Much more important are the drivers that are allowing the cargo market to stretch its wings over the long term—in particular e-commerce, which has further accelerated the package boom.”

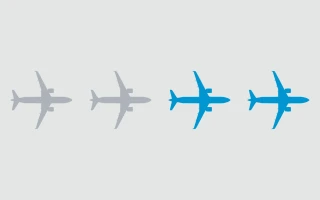

Increase in aircraft in service in the cargo sector per year measured against 2010 (%)

Air freight is gaining momentum: Since 2010, the proportion of narrowbodies and widebodies in service in the cargo sector has increased by almost 50 percent.

Even consumers who, until the pandemic, had rarely ordered anything on the internet got more accustomed to shopping online as shops and restaurants closed for weeks or even months at a time. No one ordering online wants to wait weeks to get their hands on their eagerly anticipated goods. Deliveries must be made swiftly—within one to two days, if possible. “By keeping delivery and handling times short and offering a high level of flexibility and reliability, air freight logistics providers pulled out all the stops to ensure goods are delivered on time,” says Daniel Giesecke, Strategy Consultant – Aftermarket Analysis at MTU.

Amazon, for instance, wants to deliver a portion of its customers’ orders using its own aircraft in the future. Up to now, the online retailer has mainly been leasing aircraft, a common practice in the freight business. At the beginning of 2021, Amazon announced it had purchased 11 Boeing 767-300 aircraft for its freighter fleet. It bought these aircraft secondhand from Delta and WestJet, airlines that are operating few or no passenger services due to the pandemic.

©Amazon, 2016 Chad Slattery

From passenger jet to freighter: This year, Amazon Air purchased four Boeing 767-300 aircraft from WestJet that are currently being converted to transport freight instead of passengers.

From passenger jet to freighter

The Boeing 767-300ER—a version of the 767-300 that offers extended range and an additional fuselage tank—counts as one of the trusted workhorses of the skies, operating predominantly on long-haul routes. Other such aircraft include the B777-200LRF and 747-BF, the B747-400ERF and B747-400BCF, the McDonnell Douglas MD-11F and the Airbus A300-600F. All of these make good freighters because of their range, cargo capacity and operating costs. Goods are being transported in new cargo aircraft as well as in former passenger jets that have been converted into freighters.

©Airbus

©Airbus

©Airbus

No freight overnight: If passenger jets are to start a new life as freighters, they must first undergo a complex and costly conversion.

“Up to now it’s mainly widebodies that have been converted to start a new life as freighters after fulfilling their intended purpose as passenger aircraft,” Giesecke says. “In response to the global boom in e-commerce, logistics companies have also been increasingly using converted narrowbodies—in other words, short- and medium-haul jets. These can be loaded more quickly and thus get the goods to their destination faster.”

Smaller aircraft are becoming an increasingly integral part of freight transport. “Goods are transported on widebodies from the central pick-up point to an international air freight hub, where they are transferred to smaller freighters bound for smaller destination airports. This is much faster than the alternative, which would be for the goods to complete the last leg of their journey on trucks,” Niffka explains.

Customers expect ever shorter delivery times

There can be no question that narrowbodies are the rising stars of the booming cargo business. Passenger jets like the Boeing 737-800 or the Airbus A321 are being converted into freighters. This is how Lufthansa Cargo, for instance, is expanding its own freight capacity. Starting in 2022, the company will be using two A321 aircraft that have been converted to transport freight rather than passengers on continental routes within Europe. As part of the conversion, these medium-haul jets are fitted with cargo doors so that they can carry containers on the main deck as well. Lufthansa Cargo says that since customers expect shorter and shorter delivery times, demand for air freight connections within Europe is also on the rise. The A321 can accommodate 28 metric tons of cargo at a time—considerably more than can be transported in the belly of a short-haul jet.

When passenger jets are converted into freighters, many cargo companies choose older models. “Most popular are aircraft that are around 10 to 15 years old because then the costly conversion is worth it,” Niffka says. Simply removing the seats in order to pile packages in the cabin is neither efficient nor permissible. Jets that are approved for passenger transport are generally not allowed to switch overnight to transporting freight in their cabin. In addition, the structural resilience of a passenger aircraft is lower than that of a freighter. Not to mention that bulky pieces of freight will not fit through doors that were designed to admit passengers. Large loading doors must be retrofitted.

Special service for maintenance

In freight operations, for which older series are preferred, the advantages of modern jets often don’t count for much. “It pays to use older models on some routes and new aircraft on others,” Niffka says. This depends on a variety of factors, such as the operator and their business model, freight type, fuel prices, obtainable freight rates and usage. “Freighters tend to spend more time on the ground, often fly only at night and spend less time overall in the air than passenger aircraft,” Niffka says.

Quality, reliability, safety: MTU Maintenance is a perfectly positioned MRO partner that knows precisely what its cargo customers need and want.

But when it comes to maintenance, owners of older aircraft with proven propulsion technology don’t have to compromise at all on quality, reliability or safety—the same high standards apply in the freight business as in passenger air travel. The new dynamics that are shaping the cargo market mean that cargo customers have additional requirements and expectations. For this reason, Luc Morvan, Head of the MTU Maintenance Lease Services office in Singapore, and Les Cronin, Senior Director of Sales, The Americas at MTU Maintenance in Atlanta, had an in-depth discussion about trends, challenges and service requirements in the air freight business.