aviation

Modern narrowbodies powered by GTF engines are back

The market for short- and medium-haul jets is the first to recover from the crisis. Many airlines are giving preference to their newest aircraft with highly efficient engines.

08.2021 | author: Nicole Geffert | 6 mins reading time

author:

Nicole Geffert

has been working as a freelance journalist covering topics such as research and science, money and taxes, and education and careers since 1999.

A glance upward at the cloudless sky reveals a plane glittering in the sun; a second one follows shortly thereafter. And suddenly, there it is: a feeling of wanderlust. Finally, a chance to take off and travel again. Plenty of other people share this longing. And indeed, more people are now flying again—on domestic business trips and abroad on vacation. The aviation industry is beginning to recover from the Covid-19 crisis.

“What we’re seeing during the pandemic is that the market for short- and medium-haul jets, known as narrowbodies, has emerged as the one that is recovering fastest,” says Marko Niffka, expert for Business Development – MRO at MTU Aero Engines. According to market analyses, the earliest signs of recovery are in demand for domestic and vacation flights—exactly the market that narrowbody jets in particular serve.

“Here, new aircraft models with highly efficient engines are ahead of the game.”

Expert in market analysis at MTU

Latest engine technology on board

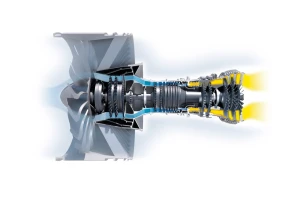

Another trend is also emerging: fuel efficiency and plans to make flying more climate-friendly, to which government support is often tied, mean that airlines are giving preference to the modern aircraft models in their fleet, which have the latest engine technology on board. In the case of narrowbodies, this is primarily the Airbus A320neo powered by the PW1100G-JM, which belongs to the successful Pratt & Whitney GTF™ engine family.

“There is a clear preference for the modern fleet,” says Dr. Marc Le Dilosquer, expert in market analysis at MTU. “Airlines are looking primarily at operating costs. Here, new aircraft models with highly efficient engines are ahead of the game. This is down to the lower fuel consumption and lower maintenance costs of newer aircraft, which are the main drivers for airlines to give preference to these aircraft. For the time being, they’re using older models less than before the crisis and leaving them on the ground more often.”

A320 family production rate on the rise

Aircraft manufacturer Airbus expects the commercial aircraft market to recover to pre-Covid-19 levels between 2023 and 2025—led by the single-aisle segment, which covers aircraft with one aisle and five to six seats per row. For its A320 family, for example, Airbus confirmed in May this year an average production rate of 45 aircraft per month in the fourth quarter of 2021 and asked its suppliers to prepare for the future by securing a fixed rate of 64 aircraft by the second quarter of 2023. In anticipation that the market will continue to recover, Airbus expects to reach a rate of 70 aircraft by the first quarter of 2024 and is exploring options for rates of up to 75 aircraft by 2025.

Narrowbodies on long-haul routes

There is a sense in the industry that things are on the up. What’s more, airlines are responding flexibly to the current situation. “The top priorities are economy and efficiency. At a time when fewer passengers are checking in, airlines are opting to use smaller aircraft with lower capacity, even for longer routes,” says Bernhard Köppel, an expert in flight physics and operating cost analysis at MTU. “These are cheaper to operate and reduce commercial risk for the airline.”

Using single-aisle aircraft instead of widebodies on medium-haul and shorter long-haul routes represents a huge cost saving. “Widebodies are typically 50 percent costlier to operate per flight; this is also known as trip cost. It won’t make commercial sense to use them until demand returns to levels that will fill most of their seats,” Köppel says.

A320neo: The aircraft features new engines and improved aerodynamics. The suffix “neo” stands for “new engine option.”

Greater range, lower capacity

Airbus has responded to current demand by developing the A321LR (Long Range) and A321XLR (Xtra Long Range) long-haul models. With additional fuel tanks and higher take-off weight, these increase the range of the A321neo base model from 6,850 kilometers to 7,400 kilometers (A321LR) and 8,700 kilometers (A321XLR). Boeing doesn’t currently offer a comparable, competitive model from the 737 MAX family.

Airbus’s new long-haul models will enable connections between, for example, Western Europe and the East Coast of the United States, Europe and India, Australia and Southeast Asia, or the Middle East and South Africa. They can also serve smaller airports. And they provide plenty of power: “The PW1100G-JM engine already delivers enough thrust to get both new models safely into the air,” Köppel says.

The U.S. airline JetBlue, an MTU Maintenance customer, has added to its fleet, taking delivery of its first A321LR powered by PW1100G-JM engines in April this year. Back in April 2019, JetBlue converted 13 aircraft of its existing A32 orders to the LR version and 13 more aircraft to the XLR version. This will enable the airline to operate transatlantic flights between the U.S. and London for the first time and offer its customers other new routes. For JetBlue, the new models open up a market that it was unable to serve it with its previous fleet—all thanks to the longer range of the A321LR.

MTU positioned for success

The first-generation GTF engine has already enabled airlines to save more than five million metric tons of CO2 in flight to date. Compared to its predecessor, the PW1100G-JM represents a reduction in fuel consumption and associated carbon dioxide emissions of around 16 percent each and its noise footprint on the ground during takeoff is some 75 percent smaller. The new engine also brings significant improvements in terms of NOx emissions, which are 50 percent lower than those of its predecessor.

MTU is involved not only in the development and production of Pratt & Whitney’s GTF™ engine family but also in its maintenance. “In the current situation, MTU’s positioning has particular advantages,” Niffka says. “We have a strong focus on engines for narrowbodies and are benefiting from the GTF’s market success. In both the OEM and MRO sectors, we are ideally positioned as a partner for airlines and Pratt & Whitney.”

For one thing, MTU is a reliable partner in the worldwide MRO service network for the PW1100G-JM. This network gives customers access to maintenance facilities—known as shops—that have experience, know-how, and capacity and offer high-quality services.

Operating cost per flight and seat mile

Operating cost per seat mile is a decisive metric for assessing a commercial aircraft’s economic efficiency. Larger aircraft typically have higher operating costs per flight, but a lower operating cost per seat mile when fully loaded. The term COC (cash operating cost) has become established for assessing the direct costs of operating a flight. COC includes crew (cockpit & cabin), fuel, maintenance (airframe & engine), navigation, and airport (landing & handling) charges.

It includes fully three facilities within the MTU network, each offering full disassembly, assembly and test capabilities for the PW1100G-JM. MTU Maintenance Hannover has been providing maintenance services for the PW1100G-JM since 2016. EME Aero, the MRO joint venture between Lufthansa Technik and MTU in Jasionka, Poland, opened its doors in 2020. MTU Maintenance Zhuhai is the latest partner to join the global MRO network for the PW1100G-JM. It is setting up another site specifically to handle this work.

“Having established a successful market position for itself with the V2500, one of the most successful narrowbody engines of all time, MTU was well placed to become such a strong partner in the GTF network, too, and provide the top-quality support,” Niffka says.

Flexible in every way

Moreover, as an independent maintenance provider, MTU Maintenance is a global player—especially in the narrowbody market. This is primarily due to the comprehensive services it offers, which cover the entire lifecycle of engines and are tailored to specific customer requirements. MTU can also offer its customers MRO services at locations all over the world. “Airlines want more flexibility,” Niffka says, “and we can provide that flexibility in every way—either as an independent MRO service provider or as part of the successful OEM network for the PW1100G-JM.”